Contents

Where the revenue expenditure is an investment of money that is periodically done. It does not benefit either the business or lead to any loss in any way. Whereas on the other hand, capital expenditure is the https://1investing.in/ long-term investment that only benefits the business. Instead, the organisation must recover the cost of such assets by annual depreciation over the years the asset is being of use to the organisation.

The company that uses its human resources, machinery, and infrastructure to make the most money is a promising investment. When investors compare a highly profitable company to one that is just breaking even, the profitable company is more attractive. Profitability is a reliable measure of a company’s performance regardless of its size and scale.

What is AC and MC?

Marginal cost is defined as the extra cost that is incurred to produce one additional unit of output. Average cost is defined as the total cost per unit of output.

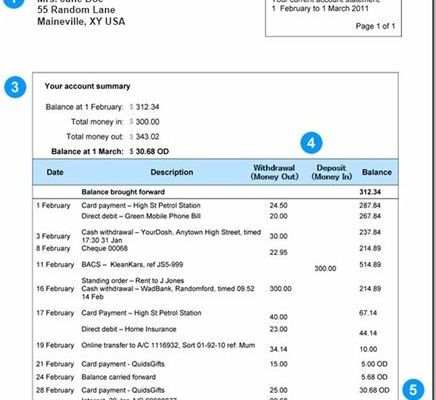

The profit made is essential for the company to keep itself in business and to have enough money to expand and grow without incurring debt. A company’s profit can be calculated from the cash flow statement and the income statement. The cash flow statement tells the reader how much money has come in and how much is going out in a particular time period. The difference between the two is the profit or the loss of the company.

What is gross profit?

It then becomes essential that the stakeholders have total awareness of these figures so that they can work towards reducing costs and increasing revenue. They have a huge role to play in the overall development and growth of a firm, both in the short as well as the long run. Net loss usually happens in upcoming and new businesses, and they do not have enough money to pay expenses, taxes, etc. In such a case, the business head should track all his expenses, try to detect areas, and make changes to reduce expenses without affecting the efficiency of the business. A budget should be planned in a strategic manner so that losses in a business can be avoided after-tax deduction.

What is the difference between TC and TR?

TC is the Total Cost Curve and TR is the Total Revenue Curve. Also, P is the equilibrium point where the distance between TR and TC is maximum.

Furthermore, it even impacted the operating margins of the company in a negative way for the current year. To make financial decisions because this does not include all the expenses such as taxes, interest on loans, etc. Another way to calculate revenue is to subtract the cost of goods sold from the total sales. Now, to deduce the differences between the two metrics, the following is a debate of gross profit vs net profit pertaining to financial treatment.

Gross Profit Analysis

In the following example, we are looking at an annual income statement for Excel Technologies for the year 2018. Understanding gross profit trends, on the other hand, can help you find ways to minimize the cost of goods sold or raise your product prices. And if your gross profit is less than your net profit, then you know that you need to find a way to cut down your expenses.

Capital Expenditure, also referred to as CapEx, is the funds used by a company, firm, enterprise or an organisation to acquire, upgrade and maintain its fixed assets. Such assets include its PP&E (i.e. its Plants, Property and Equipment) which are mainly, workstations, machinery, infrastructure, etc. Such assets are usually long-term and offer productivity for more than one accounting period. Cost volume profit analysis is a technique for studying the relationship between the cost, volume and profit. Profits of an undertaking depend upon a large number of factors such as the cost of manufacturing, volume of sales and the selling prices of the product.

In the case of non-profit organizations, their gross receipts are their source of revenue. The components of their revenue are donations, from various sources, investments, activities related to fundraising, and membership fees. It refers to the expenditure incurred by the producer on the production of a commodity.It refers to the money received from selling the produced commodity. Most government forms and tax forms require you to declare your net profit.

PROFIT /VOLUME RATIO (P/V ATIO OR C/S RATIO

A company’s ability to generate profit is a key indicator of its financial health and success. In cases where a company offers different products or services at different prices, the revenue can be calculated by summing the revenues from all products or services. If we talk about investments in real estate, their revenue is the money produced by a property via rent or parking charges. The net operating income is calculated by deducting the expenses incurred in operating the property from the income generated from the property. It is essential for the cash flow statement to be checked in order to make an assessment regarding the company’s efficiency in collecting the owed money. However, cash accounting would record sales as revenue only when the payment is received.

- Fuel to cost more in Punjab; state govt imposes 90 paise per litre cess on petrol, dieselHe was speaking to reporters after the cabinet meeting.

- The profit tells you how much the company has gained in terms of money after its expenses.

- The price of products sold is listed subsequent, adopted by different bills such as promoting, general and administrative expenses, depreciation, curiosity paid and taxes.

- Instead, the organisation must recover the cost of such assets by annual depreciation over the years the asset is being of use to the organisation.

- Under variable costing, price of products sold contains variable labor, supplies and overhead prices.

It comes in handy in assessing the proficiency of a firm in using raw materials, manufacturing equipment and labour. In simple words, gross profit denotes a venture’s profit before its expenses are deducted and happen to be an item under Trading Account. Notably, gross profit comes in handy for determining the efficiency of a firm is using its raw material, labour and production supplies.

More Money and Banking Questions

Is quite excited in particular about touring Durham Castle and Cathedral. I assure you I benefited in gaining insights to these complex concepts.

For e.g., the financing department in a recreational vehicles department may have a distinct source of revenue. Revenue and earnings per share are the two figures that receive the most attention when quarterly earnings are reported by public companies. TC is regarded as the difference between revenue and cost is called the expenditure for any business enterprise.TR is regarded as the income for any business enterprise. It increases with an increase in production or output.It increases with an increase in sales. Knowing about the same has several advantages beneficial for the business.

Also, a firm with a substantial gross profit may still incur a net loss as it entirely depends on the firm’s accumulated expenses. In an interview, Cook told Reuters that the production disruptions that plagued Apple’s key quarter were now over. If we talk about the government, the money they receive from fines, taxation, sale of securities, rights on minerals and resources, fees, and the sales is their revenue.

Non-operating revenue meaning is the money generated from secondary sources of revenue. The non-operating revenues cannot be predicted very often and they are non-recurring in nature. For e.g., Money from selling an asset, and money received from investments are non-operating revenue sources. However, precisely what’s included in price of goods bought is determined by the costing system the corporate employs. The two main types of costing techniques utilized by firms with stock are absorption costing and variable costing. Absorption costing provides fixed manufacturing overhead, similar to rent or property tax, to the price of items offered.

What does TR stand for economics?

The sum of revenues from all products and services that a company produces is called total revenue (TR).

If the cost of gross sales is rising while income has stagnated, it might be an indication that input prices have increased or other direct prices aren’t being appropriately managed. Cost of sales and COGS are subtracted from total revenue to yield gross profit. The price of income is the entire price of manufacturing and delivering a product or service to shoppers. The revenue in gross margin is one of the main components for the measurement of a company’s profitability. The calculation of gross profit relies mainly on the overall revenues of doing a business which is directly related to production.