Contents:

The Hammerand Hanging Man look exactly alike but have totally different meanings depending on past price action. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position. The common interpretation of the doji pattern is that it indicates indecision in the market. Price moves both higher and lower, but ultimately settles right back where it began. The security is trading above its 20-day exponential moving average . The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

Three black crows is a very noticeable bearish pattern, but it’s still necessary to use other technical indicators to confirm that it really does predict a downturn in asset prices. Each candle opens within the body of the previous one, better below its middle. The signal of this pattern is considered stronger than a signal from a simple evening star pattern.

Live prices

The kicking candlestick pattern consists of two opposite-colored marubozu candlesticks and a gap between them. It is also further classified into a bullish kicking pattern and a bearish kicking pattern. The lower wick of a forex hanging man pattern, however, is very long and needs to be at least two times greater in size than the body of the candle to be considered a hanging man candlestick.

In tweezer top, both https://trading-market.org/s will not have shadows on the upper side, and they will form at the top of the chart. The closing price of the first candlestick will be equal to the opening price of the second candlestick. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider.

The confirmation of the trend reversal on the third day adds strength to the signal. In the Bullish Three Inside Up, also known as the Confirmed Bullish Harami, traders may see a potential trend reversal from bearish to bullish. This means that it closes above the midpoint of the previous day’s candle. This pattern is called the “piercing line” because the signal candle pierces the previous candle’s body by at least 50%. It is worth noting that in the stock market, the piercing candle often gaps down, but this is not always the case in the forex market due to its higher liquidity and longer trading hours.

The difference is that the Doji candle will form in an abandoned baby pattern with a gap up or a gap down. This pattern is further categorized into bullish piercing and bearish piercing candlestick patterns. Not all hanging man forex patterns lead to reversals, but when a reversal candlestick confirms the pattern with an increase in volume, the probability of a reversal taking place greatly increases. After the hanging man candlestick, the very next candlestick moved lower, thereby confirming the pattern, but note how the volume started to increase again.

How to trade using bullish and bearish engulfing candlesticks – IG

How to trade using bullish and bearish engulfing candlesticks.

Posted: Fri, 04 Sep 2020 20:17:46 GMT [source]

This provides traders with a buy signal that is confirmed when the price moves to a new high on the third candle. They would enter a trade at the top of the third candle’s wick and place a stop loss below the second. This means that buyers attempted to push the price up, but sellers came in and overpowered them. This is a definite bearish sign since there are no more buyers left because they’ve all been overpowered. The Inverted Hammer occurs when the price has been falling suggests the possibility of a reversal.

How to start trading?

Short Line Candles – also known as ‘short candles’ – are candles on a candlestick chart that have a short real body. A doji is a trading session where a security’s open and close prices are virtually equal. The evening star actually has two distinct patterns depending upon which market one is trading. This trade could actually be extended by the confirmation of the big Head and Shoulders pattern. Simply hold the Hanging Man trade with the same stop loss order until the price action moves to a distance equal to the size of the Head and Shoulders structure as calculated by the measured move. You can close the trade after the target is completed at the end of the big magenta arrow.

- This is a mammoth resource that contains virtually every candlestick formation you can trade in the forex markets.

- The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market.

- It begins with a long white candle on the first day, followed by a horizontal line or Doji candle on the second candle, which creates a gap in the upward trend.

- Take the low and the high of the pattern and apply this distance starting from the end of the pattern.

The most common bullish reversal patterns are the bullish engulfing pattern and the piercing line pattern. Like one-day reversal patterns, a two-day reversal pattern can be either bullish or bearish. In this section, we’ll look first at bullish and then bearish reversal patterns.

UpTo 5K Bonus Limited Time

Ability to read the market sentiment with these candlestick pattern. This is because initially one side of the market is more dominant, and therefore more successful in pushing the price into their desired direction. After some time, the balance becomes more even as the other side starts growing in the game. Finally, the change in the trend direction is taking place as the other side has now become more dominant. Traders often enter the market on the open price of the first bearish candle after the engulfing and place a stop-loss order underneath the second candle’s low.

As you can guess from the name, this pattern consists of three (often long-bodied) bearish candlesticks that open higher than the previous candle, but close much lower. This pattern shows that sellers have managed to push the prices of assets down three times in a row and now overtook buyers. A white/black or white/white combination can still be regarded as a bearish harami and signal a potential reversal.

The bigger the difference in the size of the two candlesticks, the stronger the buy signal. A small white or black candlestick that gaps above the close of the previous candlestick. This candlestick can also be a doji, in which case the pattern would be an evening doji star.

The three stars in the south candlestick also consist of three bearish candles, but each candlestick will form within the range of the previous candlestick like inside bar candle. This pattern should form at the support or demand zone to get a high probability trend reversal signal. The piercing candlestick pattern consists of two opposite colour candlesticks in which the second candlestick must cross the 50% Fibonacci level of the first candlestick. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. The large sell-off is often seen as an indication that the bulls are losing control of the market. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon.

Tweezer top & Tweezer bottom candlestick pattern

The shooting star pattern appearing as soon as the RSI moves above the 70 levels and into overbought territories should be a warning sign of potential price reversals. The shooting star pattern can occur when trading any security from forex to commodities and even stocks. It is not limited to a particular instrument as it is a function of trader’s sentiments and price action. The sell signal is confirmed when a bearish candlestick closes below the open of the candlestick on the left side of this hanging man candlestick pattern.

However, as the market becomes overbought, some investors start to close their positions to take profits, leading to a wave of selling pressure that causes prices to drop. A gravestone doji is a type of candlestick pattern that appears on a chart for a stock or other asset. What this pattern indicates is that sellers are still participating at these prices and are not willing to give up. Eventually, the buyers overpower them and bring the price higher, thus creating a bullish reversal.

The Morning Doji is a three-candle pattern that signals the end of an uptrend. It consists of a long black candle followed by a small-bodied candle, and a third white bullish candle that closes within the body of the first black candle. This strong buying pressure absorbs the selling pressure and pushes the price back above 50% of the previous day’s candle, signalling the intention of buyers to push the price higher. As a result, this pattern can provide traders with insight into a shift in trading bias and the opportunity to take advantage of it. Reversal patterns refer to chart arrangements that happen before a chart starts a new trend.

These candlestick patterns will work almost in every time frames, but mostly in higher time frames like 1 hour charts, 4 hour charts, Daily charts, or weekly – monthly charts. Even scalping strategies can be made with these candlestick patterns. No matter which timeframe or strategy you follow to trade the forex and stocks with these candlestick patterns, always try to find out these patterns at the right position of the market. They are also called “spike” reversals, or the V-bottom, as the price action tends to spike lower, before the counter-spike to the upside occurs.

Shooting Star Pattern Candlestick Psychology

The information provided by StockCharts.com, Inc. is not investment advice. The Falling Three Methods is a trend continuation pattern that signals a potential weakening of the current trend. However, in the fourth session, there was a sudden increase in sellers, indicating that resistance has been found and that these sellers want to enter the market. During the first three sessions, the sellers had a strong presence and pushed the price lower, indicating their desire to continue driving the price higher and their control over the market.

- In the forex market, there is no gap between the candlesticks (since it’s a twenty-four-hour market gaps are rare, apart from resumption of trading on Sunday evenings).

- The sellers were so dominant that they erased the gains of the previous three sessions, demonstrating a significant influx of new sellers into the market.

- The long white candlestick confirmed the direction of the current trend.

- The price of the asset is growing slowly, but surely, when it suddenly spikes, then evens out, and just as suddenly decreases, signaling a new downtrend in price movement.

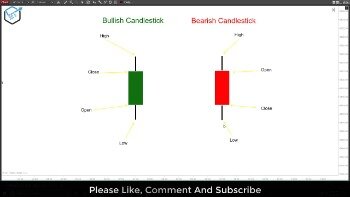

A spinning top is a candlestick pattern with a short real body that’s vertically centered between long upper and lower shadows. With neither buyers or sellers able to gain the upper hand, a spinning top shows indecision. A daily candlestick represents a market’s opening, high, low, and closing prices. The rectangular real body, or just body, is colored with a dark color for a drop in price and a light color for a price increase.

Knowing when to bullish and bearish candlestick patterns forex the market is one of the most important skills in Forex trading. We should aim to hop into emerging trends as early as possible in order to catch the maximum price swing. One of the best ways to do this is by predicting potential reversals on the chart. In this lesson, we will discuss some of the top Forex reversal patterns that every trader should know. Some are used in forex trading, some are explicitly used in stocks or indices trading, and a few are universal candlestick patterns. The opposite is true for the bullish pattern, called the ‘rising three methods’ candlestick pattern.

When the price breaks the Neck Line, you get a reversal trading signal. This is when you would want to initiate a trade to the short side. The minimum price move you should aim for when trading a candle reversal formation is equal to the size of the actual pattern itself. Take the low and the high of the pattern and apply this distance starting from the end of the pattern. If after you reach that level, you may decide to stay in the trade for further profit and manage the trade using price action rules. The belt hold pattern also consists of two opposite color candlesticks.

Look at The structure of the morning doji star pattern in the image below. There are 12 reversal candlestick patterns cheat sheet so far that are used in technical analysis to predict a trend reversal. Reversal patterns are the opposite of continuation candlestick patterns. Also, reversal patterns need more time to form than the continuation formations as it is easier for the market to continue in the same direction than change its course.

As we see from this chart, a shooting star appears at the height of an uptrend. But the subsequent rejection of the price by sellers indicates the start of a new downward trend. So we can conclude, that a shooting star is likely a sign that asset prices are about to go down. The second candlestick is quite small and its color is not important. The third bearish candle opens with a gap down and fills the previous bullish gap. This pattern produces a strong reversal signal as the bullish price action completely engulfs the bearish one.

What are stock trading signals? Beginners Guide 2023 – FX Leaders … – FX Leaders

What are stock trading signals? Beginners Guide 2023 – FX Leaders ….

Posted: Mon, 06 Feb 2023 09:10:56 GMT [source]

When the second candlestick gaps up, it provides further evidence of residual buying pressure. However, the advance ceases or slows significantly after the gap and a small candlestick forms, indicating indecision and a possible reversal of trend. If the small candlestick is a doji, the chances of a reversal increase. The third long black candlestick provides bearish confirmation of the reversal. For those that want to take it one step further, all three aspects could be combined for the ultimate signal.

How to trade the doji candlestick pattern – FOREX.com

How to trade the doji candlestick pattern.

Posted: Wed, 16 Nov 2022 08:00:00 GMT [source]

The pattern has an extremely small body and small upper and lower shadows as well. The latter candle usually engulfs the body and shadows of the initial candle. The previous trend before the emergence of the shooting star pattern should be bullish. A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Both patterns suggest indecision in the market, as the buyers and sellers have effectively fought to a standstill.